2 Stocks That Are Absurdly Cheap Right Now

Copper miner Freeport-McMoRan (NYSE: FCX) and GE Healthcare Technologies (NASDAQ: GEHC) are both compelling buys based on their current earnings and their growth potential. Here’s why they are worth adding to a diversified portfolio.

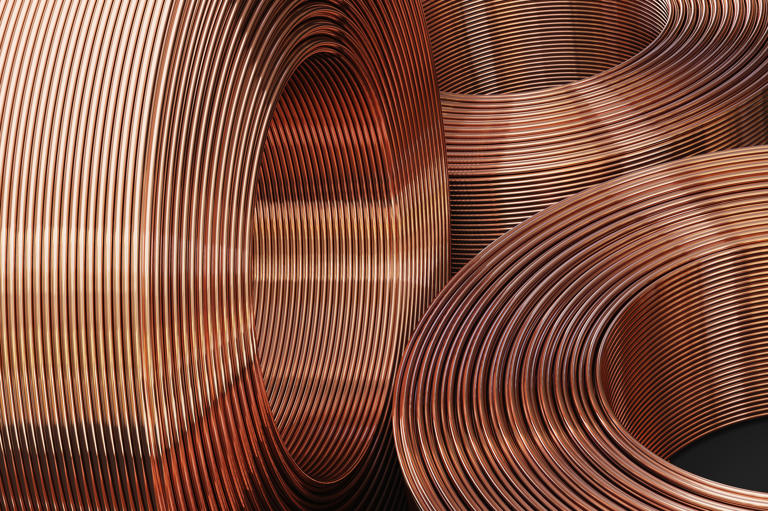

Freeport-McMoRan electrifies the future

The case for copper is based on a long-term marginal increase in demand from the “electrification of everything,” a catch-all phrase to describe the increase in investment in clean and connected technologies that use electricity. This includes 5G infrastructure; industrial automation; smart buildings/infrastructure; electric transport, including trains and electric vehicles (and charging networks); and renewable energy, including transmission and distribution networks.

On the supply side, the increasing difficulty of obtaining mining permits due to environmental regulation implies restrictions on new supply.

If you believe in a future shaped by these demand and supply forces and a long-term uptrend in the price of copper, then Freeport-McMoRan is pretty much a no-brainer stock to buy. The company’s revenue and earnings are a factor of the price of copper.

Freeport-McMoRan is a buy even for those who don’t think the price of copper will surge

That said, there are two other powerful arguments in favor of buying Freeport-McMoRan, and they apply even if you are neutral on where the price of copper is headed.